AI, Tariffs, and Inflation: 3 Important Takeaways from the Bank of Canada’s Latest Move

Thursday Jan 29th, 2026

Share

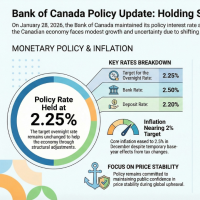

AI, Tariffs, and Inflation: 3 Important Takeaways from the Bank of Canada’s Latest Move In the world of central banking, a "hold" is rarely just a pause—it is a positioning. On January 28, 2026, the Bank of Canada kept its target for the overnight interest rate at 2.25%, but the accompanying rhetoric suggests a Governing Council navigating a razor’s edge. We are no longer in an era of predictable cycles; we are in a state of "upheaval."... [read more]

.png)

.png)