AI, Tariffs, and Inflation: 3 Important Takeaways from the Bank of Canada’s Latest Move

Thursday Jan 29th, 2026

AI, Tariffs, and Inflation: 3 Important Takeaways from the Bank of Canada’s Latest Move

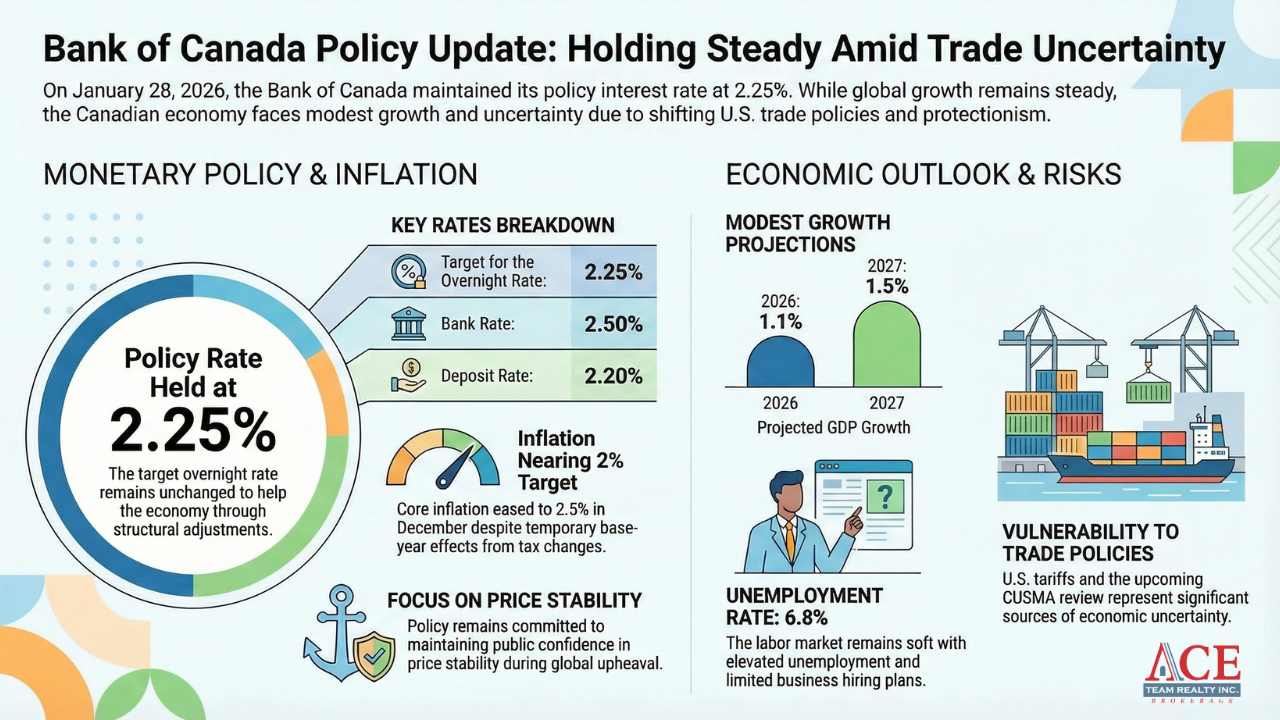

In the world of central banking, a "hold" is rarely just a pause—it is a positioning. On January 28, 2026, the Bank of Canada kept its target for the overnight interest rate at 2.25%, but the accompanying rhetoric suggests a Governing Council navigating a razor’s edge. We are no longer in an era of predictable cycles; we are in a state of "upheaval." This latest decision is a calculated response to a global landscape where the old rules of trade are being rewritten by protectionist policy and technological surges. For the Canadian investor and observer, the macro-narrative is shifting from simple recovery to a complex, multi-year reconfiguration.

The AI Engine and the US Growth Paradox

The United States economy is currently defying gravity, and it is doing so via two distinct engines: a massive surge in AI-related capital investment and resilient consumer spending. On paper, a booming southern neighbor is good for Canada, but today’s reality is a double-edged sword. While US growth provides a floor for global demand—helping keep the Canadian dollar above 72 cents—it also brings the volatility of "Trump-trade" inflation.

The paradox is clear: US strength is now tethered to aggressive tariffs. While AI investment fuels productivity gains in the States, those same trade restrictions are beginning to leak into price data. For Canada, the benefit of proximity is being tempered by the cost of friction. Furthermore, with oil prices now fluctuating slightly below the levels projected in the October report, the Bank is forced to balance a weakening commodity outlook against a US economy that is overheating in all the wrong places for its trading partners.

The "Tax Holiday" Mirage: Why Inflation Isn't What It Seems

The headline-grabbing December CPI print of 2.4% might tempt the uninitiated to call for a rate hike, but the Bank is wisely looking past the noise. This spike is a mathematical distortion—a "base-year effect" caused by last winter’s GST/HST holiday. When you strip away these temporary tax fluctuations, the underlying trend is actually one of cooling.

The macro-strategist’s focus remains on the Bank’s preferred core measures, which have eased from 3.0% in October to approximately 2.5% in December. This downward trajectory gives the Bank the breathing room to ignore the 2.4% mirage. The Bank is effectively betting that the downward pressure from a cooling domestic economy will be enough to anchor prices despite the external chaos.

"The Bank is committed to ensuring that Canadians continue to have confidence in price stability through this period of global upheaval."

The Tariff Shadow: A Long Road of "Structural Adjustment"

If the US is an engine, the Canadian economy is currently a vehicle with its brakes partially engaged. After a healthy third quarter, GDP growth stalled in Q4 2025. This isn't a mere dip; it is the physical manifestation of US trade restrictions and the heavy psychological weight of the upcoming CUSMA review.

The labor market reveals the most striking tension. We are seeing a counter-intuitive reality: while employment numbers have risen, the unemployment rate remains "elevated" at 6.8%. Businesses are staying lean, hesitant to hire as they wait for the next trade shoe to drop. This creates a state of "excess supply" in the labor market. While difficult for the worker, this slack provides the Bank with a crucial buffer; it allows trade-related cost pressures to be absorbed without triggering a wage-price spiral. This is the heart of what the Bank calls a period of "structural adjustment." Monetary policy is no longer just about managing growth; it is about facilitating a painful transition to a more protectionist global order.

Conclusion: The Question of Resilience

The Bank of Canada has signaled a "wait and see" posture, projecting modest growth of 1.1% for 2026 and 1.5% for 2027. It is a cautious outlook that assumes the domestic "excess supply" will act as a sufficient heat shield against incoming tariff-driven inflation.

The defining question for the next eighteen months is whether Canada can successfully pivot its economic engine. Can a middle power find a sustainable path to prosperity in a world defined by AI-driven growth and protectionist barriers, rather than the open, traditional trade that built our modern economy? The Bank is holding steady at 2.25%, but they have made it clear: if the "structural adjustment" turns into a structural breakdown, they are prepared to move.

Source:

Bank of Canada: https://www.bankofcanada.ca/2026/01/fad-press-release-2026-01-28/

Post a comment