Toronto Regional Real Estate Board Forecasts Strong Demand in Housing Market in 2021

Wednesday Feb 10th, 2021

Toronto Regional Real Estate Board Forecasts Strong Demand in Housing Market in 2021

The outlook for the GTA real estate market is healthy with strong buying intentions, a near-record sales forecast of more than 100,000, and a record average selling price over $1 million.

Today, the Toronto Regional Real Estate Board (TRREB) is unveiling its must-read Market Year in Review & Outlook 2021 Report and eagerly awaited digital digest containing TRREB’s annual market outlook, up-to-date Ipsos consumer polling results, the most recent Altus new home and commercial statistics, rental market trends, research on innovative approaches to bring on more housing supply and mortgage market trends.

“The pandemic certainly resulted in an unprecedented year for real estate in 2020, but it hasn’t put a damper on the overall demand,” said Jason Mercer, TRREB Chief Market Analyst. “Looking ahead, a strengthening economy and renewed GTA population growth following widespread vaccinations will support the continued demand for both ownership and rental housing. But over the long run, the supply of listings will remain an issue, particularly in low-rise segments.”

2021 Market Outlook

• Combined home sales reported through TRREB’s MLS® System for the GTA, South Simcoe County and Orangeville are expected to reach 105,000.

• Strong sales growth will be supported by continued economic recovery, including jobs and record or near-record lows for borrowing costs.

• The pace of new condominium apartment listings will start to ebb, especially in the second half of the year. With low-rise listings remaining constrained, expect total new listings to come in at the 160,000 mark.

• Market conditions for low-rise homes, including detached houses, will remain very tight, with sales rising at a faster pace than listings.

• The overall average selling price for all home types and areas combined will eclipse the $1,000,000 mark for the first time, reaching $1,025,000 and representing a year-over-year increase of 10 per cent.

• While mortgage deferrals were initially a concern early on in the pandemic, Mortgage Professionals Canada does not anticipate any pronounced uptick in mortgage delinquencies that would create systemic concerns as we move through 2021. Most property owners who took advantage of mortgage deferrals did so out of an abundance of caution rather than financial necessity and therefore have resumed their regular payments.

January 2021 Market Stats

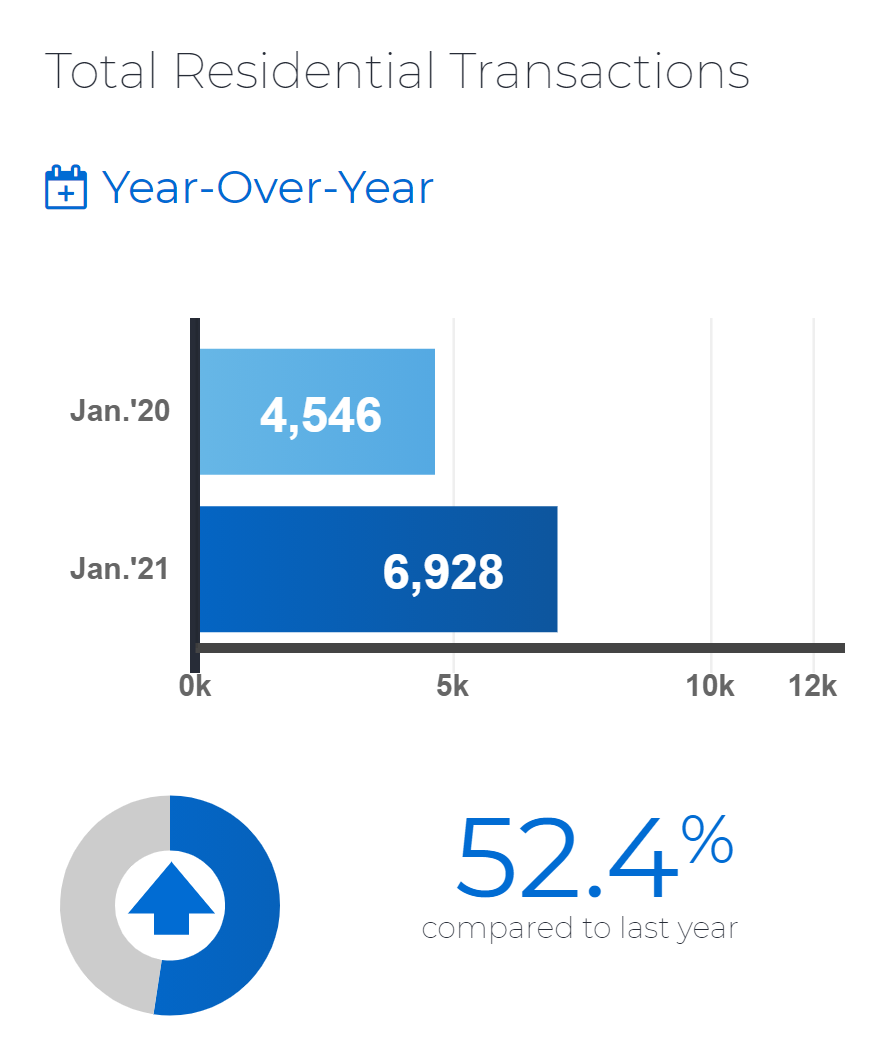

• January home sales amounted to 6,928 – up by more than 50 per cent compared to January 2020. This strong start to 2021 included sales growth across all major segments, including condominium apartments, both in the City of Toronto and surrounding GTA regions. 2

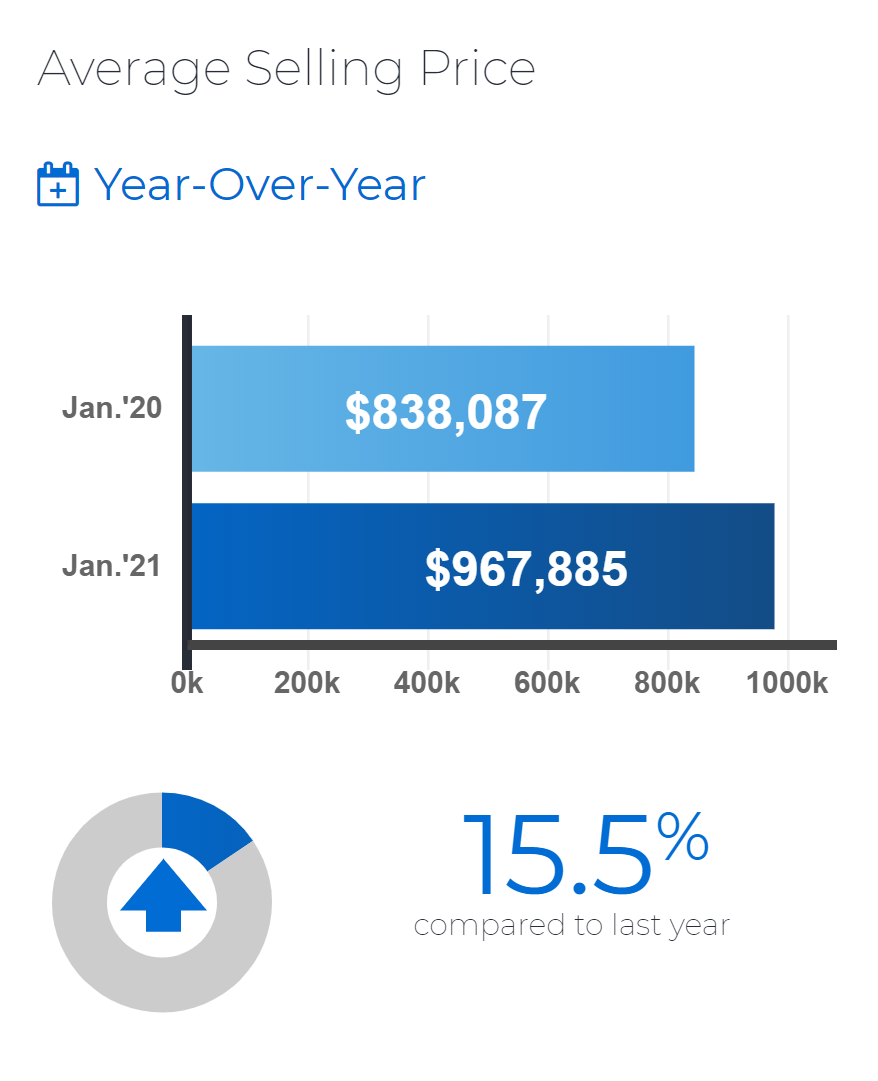

• New listings were also up on a year-over-year basis in January, but not by the same annual rate as sales. This means market conditions tightened compared to January 2020, resulting in the continuation of double-digit growth in the MLS® Home Price Index and the average selling price.

• The average selling price for January 2021 was up by 15.5 per cent to $967,885 year over year. The MLS® HPI Composite Benchmark was up by 11.9 per cent over the same period.

• Price growth was driven by the low-rise market segments, while the average condo apartment price was down in Toronto. However, if we continue to see condo sales growth outstrip condo listings growth, we could start to see renewed growth in condo prices later this year.

2020 Market Year in Review

2020 was a roller coaster year with unpredictable ups and downs, but the second half of 2020 was marked by consecutive monthly records for home sales and average selling prices. The end result was the third best annual sales total on record and a new record for the average selling price. The suburbs experienced the strongest sales growth, especially in single-family homes with the average selling price topping out at almost $930,000.

“Together as REALTORS, we’ve become an essential part of the economic recovery. The results of the past year were driven by TRREB Members who act as vital instruments driving economic activity in our communities as they work on a daily basis with home buyers, home sellers, renters and business owners,” said Lisa Patel, TRREB President.

“When the pandemic hit, TRREB outlined a detailed policy brief on government economic initiatives to municipal, provincial and federal governments. With regards to housing supply, our key recommendations are to expedite the creation of missing middle housing, that is, multi-unit low-rise housing between detached and mid- to high-rises. It is crucial that we expand these development opportunities in residential areas which are currently only zoned for detached and semi-detached housing. This is why we asked Urban Strategies to research and propose innovative and workable ideas around the provision of missing middle housing across our region,” said John DiMichele, TRREB CEO.

The Potential of the Missing Middle

Currently, there is a lack of variety in housing and due to municipal zoning restrictions most of our urban areas are occupied by low density, single-family homes. Research commissioned by TRREB and conducted by Urban Strategies found that increasing the different types of housing will address the missing middle in those areas while significantly, and quickly, alleviating the tight housing supply.

“Allowing conversions of single-family houses for additional units could result in the rapid addition of 300,000–400,000 units in Toronto and would make a major contribution to addressing housing affordability. Increasing the missing middle can also stabilize the population while helping to sustain schools, social and retail amenities,” said Joe Berridge, Urban Strategies Inc. Partner.

Discover new research on much-needed missing housing, delve into the latest market insights and trends in the full report and explore the new interactive website and videos showcasing the key takeaways from this year’s report.

Post a comment